In an economy where every dollar counts, business efficiency is everything. Fleet management software can help dealers do just that by plotting delivery routes, tracking maintenance, monitoring safety, and more. And thanks to the power of artificial intelligence (AI), offerings are getting more intelligent than ever, helping LBM business owners save time and money.

Here’s a look at some of the options to consider for managing your trucks.

Fleet Management With Route, Load, and Fuel Optimization

Using GPS, traffic data, and other tools, software programs can help dealers plan delivery routes for efficiency while automatically keeping track of hours and other factors. Many offerings are highly automated, taking the guesswork out of planning and helping you stay on top of delivery deadlines.

Trimble Route Management Suite

Trimble Transportation offers a host of fleet management solutions, including a routing and optimization suite: Trimble Dispatch Advisor, Trimble Trip Alert, and Trimble Expert Fuel. Dispatch Advisor automatically matches drivers to loads based on driver location, delivery windows, hours of service, and more. With Trip Alert, you can monitor hours of service, location, arrival time, and driver appointments to optimize routes as well as understand load balance for planning. Expert Fuel uses real-time data to suggest optimal fuel purchase options for drivers, helping to reduce costs.

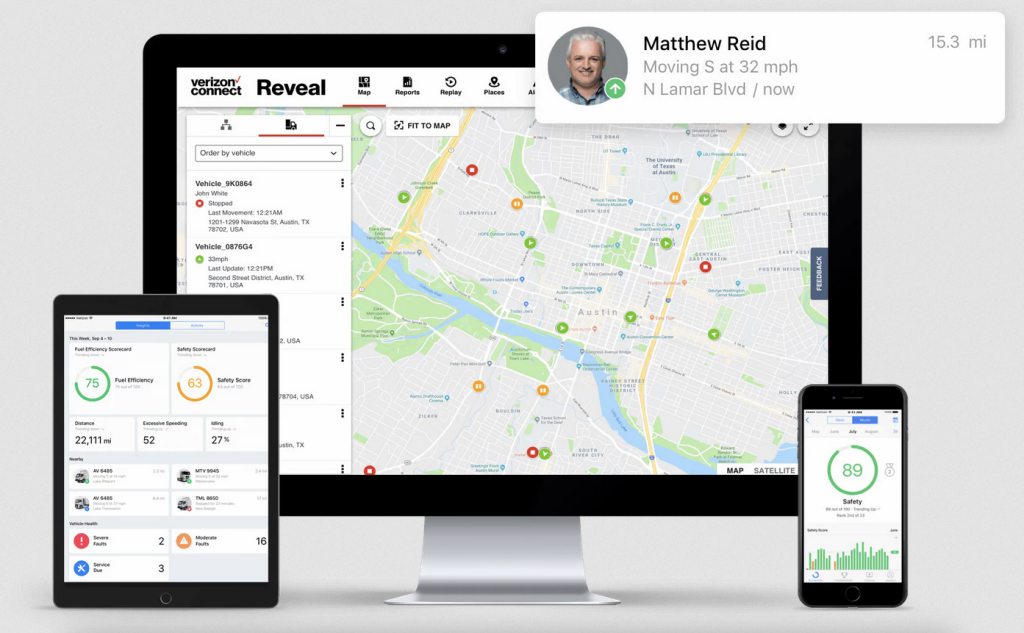

Verizon Connect Fleet Management

Fleet tracking solutions from Verizon Connect can help distributors improve efficiency by mapping drivers in near-real time, allowing you to keep customers apprised of delivery times, sending alerts upon arriving to or departing delivery locations, and providing turn-by-turn navigation. The software also can monitor driver behaviors and other factors to help improve fuel efficiency as well as track and schedule maintenance.

Fleet Management With Safety Devices

Safety monitoring is both proactive (encouraging better behavior and alerting drivers to unsafe habits) and reactive (such as providing evidence in the event of an incident), and telematics and AI tools can help. “A telematics tool like a dash camera can detect a number of things, including hard acceleration, driver drowsiness, speed limit violations, following distance, seatbelt compliance, and traffic light and stop sign violations, to name a few,” GPS Insight told Insurance Thought Leadership. “Each second is analyzed for safety via artificial intelligence to recognize risky driving behaviors—and without any human intervention needed.”

Safety AI Dash Cam from Tenna

TennaCAM 2.0 dash cam from Tenna features dual-facing HD cameras—driver-facing and road-facing—with AI functionality on the interior-facing camera. The camera monitoring and analysis provides managers with data to optimize safety, address risky driving habits, analyze near-misses, and reward better-performing drivers. The cameras pair with the company’s TennaFLEET tracker to provide GPS alerts for hard braking, rapid acceleration, speeding, and other factors as evidence after accidents or other events. The AI technology also can detect risk indicators such as distracted driving, drowsiness, or phone use.

360-Degree AI Camera from Motive

Motive says its new AI Omnicam is the first AI-enabled camera to provide side, rear, passenger, and cargo monitoring; it pairs with the company’s AI Dashcam for 360-degree views of the vehicle, its interior, and its surroundings. Together, the cameras provide insights to help companies resolve issues and streamline operations, including real-time visibility into unsafe or problematic conditions, in-cab coaching and other information to alert and educate drivers, and evidence to exonerate drivers. In the event of an accident, footage uploads in seconds and managers are provided with video and telematics data.

Fleet Maintenance Management

Poorly maintained vehicles can lead to waste—from unexpected downtimes to breakdowns that delay deliveries. Fleet maintenance technology can help track the endless paperwork and schedules while providing automatic alerts for required maintenance so nothing is missed. Some programs also monitor data to help improve fuel efficiency or determine when vehicle replacement is a more economical option.

Fleet Maintenance Software from Fleetio

Fleetio fleet maintenance management software keeps all data about your delivery vehicles—from registration renewal reminders to warranty info to telematics—in one place. It keeps a record of every activity related to each vehicle, including maintenance activities and fuel transactions, while tracking fleet costs and performance. Managers also can manage driver schedules, including assigning trucks and understanding which trucks are being underutilized. An online app allows drivers to view assignments and find vehicle documentation from anywhere.

Digital Maintenance Planning Software From Teletrac Navman

As part of Teletrac Navman’s TN360 fleet management software, the computerized maintenance management system digitizes vehicle and equipment maintenance schedules, including connecting to each vehicle’s telematics data to track the odometer and engine hours. Managers can build schedules, view a maintenance dashboard across the entire fleet, keep record of all maintenance events, and save important documents, from invoices to certifications. The same platform also can be used to manage vehicle inspections.

Stay up on the latest tools and tips by subscribing to our enewsletter.